Market Practitioners Group

In August 2018, the SARB published the “Consultation paper on selected interest rate benchmarks in South Africa”. The paper made key recommendations regarding the reform of the Johannesburg Interbank Average Rate (Jibar) and the South African Benchmark Overnight Rate on Deposits (Sabor). It proposed new interest rate benchmarks that the SARB would calculate and monitor in order to enhance the transparency of monetary policy transmission and enrich the current framework for systemic risk identification and monitoring.

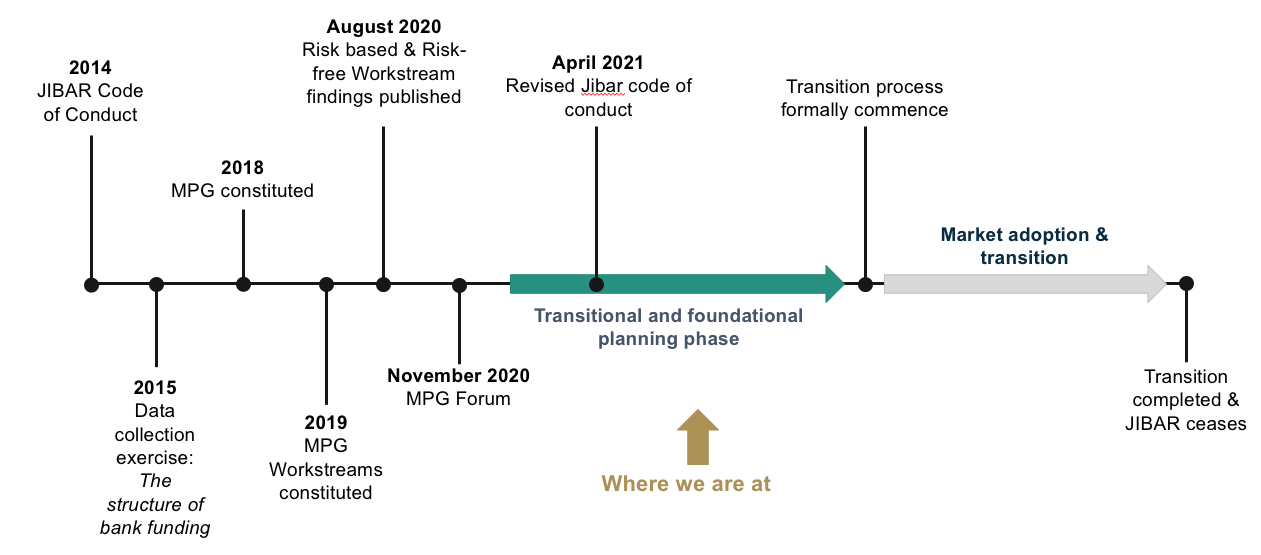

The paper recommended the establishment of the Market Practitioners Group (MPG), which is a joint public and private sector body. The primary purpose of the MPG is to make the final decisions on the choice of interest rate benchmarks to be used as reference interest rates for financial and derivative contracts, as well as to provide input to the SARB and the Financial Sector Conduct Authority (FSCA) on the operationalisation of the interest rate benchmark proposals contained in the paper.

The MPG functions alongside other structures, such as the Financial Markets Liaison Group (FMLG), and is chaired by the Deputy Governor: Markets and International of the SARB. It comprises members of the SARB and the FSCA, and senior professionals from a variety of institutions to reflect different market interest groups active in the domestic money market.

The MPG will remain in existence until the new benchmarks have been implemented and embedded, after which the Reference Rate Working Group of the FMLG will assume responsibility for further work on reference interest rates.

The MPG relies on dedicated workstreams and technical subgroups to carry out its objectives. The workstreams and technical subgroups have a responsibility for providing technical input and recommendations to the MPG on specific issues which are relevant to the transition from JIBAR, Members of these workstreams are drawn from a diverse set of market practitioners whose insights and expertise are required to give effect to the mandate of the MPG, as well as shape industry opinions on the reform agenda. To learn more about the workstreams, see below:

Terms of Reference

Agenda

Minutes

MPG Forum Presentation

Revised Jibar Code of Conduct

If you have further questions about financial markets, please do not hesitate to contact us.

Risk-Free

The Risk-Free Reference Rate workstream is mandated with reviewing proposals for the design of risk-risk rates and making final recommendations to the MPG on the choice of a suitable alternative risk‐free reference rate for South Africa.

Data Collection & Infrastructure

The DCI workstream is mandated with making final recommendations to the MPG on the model for collecting transaction data required for the calculation of new and reformed interest rate benchmarks.

Unsecured

The Unsecured reference rate worksteam is mandated with making final recommendations to the MPG relating to the choice and design of reformed interest rate benchmarks in South Africa that include bank credit risk. This workstream also had a mandate for developing proposals on strengthening the current JIBAR framework

Governance

The Governance workstream is mandated with providing input into the drafting of codes of conduct and operating rules for the key interest rate benchmarks used as reference interest rates, the design of a surveillance framework for key interest rate benchmarks used as references and the design of the control framework pertaining to the determination and distribution of interest rate benchmarks.

Transition

Transition workstream is mandated with examining options for transition from legacy reference rates to those proposed by the relevant work streams. This work entails identifying key risks (market, legal, operational, etc.) and making final recommendations to the MPG on timelines and steps of transition.

Communications

The Communications workstream is mandated with formulating and executing an appropriate communication strategy to raise awareness and educate the broad target audience about the objectives and initiatives of the reference rate reform using tailored communication channels.